Personal Loans copyright Fundamentals Explained

Wiki Article

The Definitive Guide for Personal Loans copyright

Table of Contents3 Simple Techniques For Personal Loans copyrightOur Personal Loans copyright IdeasThe Main Principles Of Personal Loans copyright Indicators on Personal Loans copyright You Should KnowHow Personal Loans copyright can Save You Time, Stress, and Money.

Doing a normal budget plan will provide you the confidence you need to handle your money effectively. Great things come to those that wait.But conserving up for the huge points implies you're not going right into financial obligation for them. And you aren't paying extra in the long run due to all that passion. Depend on us, you'll enjoy that household cruise ship or playground set for the youngsters way extra recognizing it's currently spent for (as opposed to paying on them up until they're off to university).

Absolutely nothing beats assurance (without financial debt naturally)! Financial obligation is a trickster. It reels you in just to hang on for dear life like a crusty old barnacle. You don't have to turn to personal loans and financial debt when things get tight. There's a better means! You can be devoid of debt and begin materializing traction with your money.

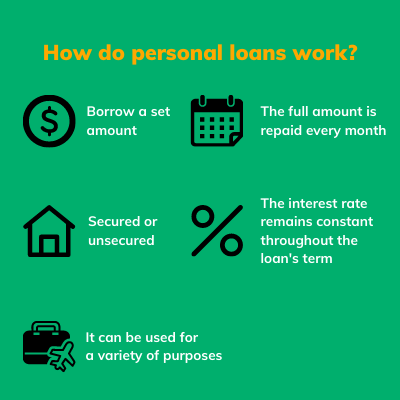

An individual loan is not a line of credit score, as in, it is not revolving funding. When you're approved for an individual finance, your loan provider provides you the full amount all at once and then, usually, within a month, you begin payment.

The Only Guide for Personal Loans copyright

Some banks put terms on what you can make use of the funds for, however lots of do not (they'll still ask on the application).At Spring, you can use regardless! The demand for individual lendings is climbing among Canadians curious about escaping the cycle of payday advance, consolidating their financial obligation, and rebuilding their credit rating. If you're requesting a personal funding, right here are some points you ought to remember. Individual finances have a set term, which indicates that you understand when the financial debt has to be settled and just how much your repayment is every month.

What Does Personal Loans copyright Mean?

Furthermore, you could be able to reduce just how much total interest you pay, which indicates even more money can be saved. Personal try this web-site loans are effective devices for building up your debt score. Settlement history make up 35% of your credit rating, so the longer you make regular settlements in a timely manner the more you will certainly see your rating increase.Individual lendings supply a terrific possibility for you to reconstruct your credit report and pay off financial obligation, however if you don't budget properly, you can dig on your own right into an even much deeper opening. Missing out on among your month-to-month payments can have an unfavorable effect on your credit rating yet missing out on a number of can be ravaging.

Be prepared to make every single settlement in a timely manner. It holds true that a personal funding can be used for anything and it's easier to obtain approved than it ever was in the past. However if you do not have an immediate demand the added cash, it might not be the best option for you.

The repaired month-to-month settlement quantity on an individual funding depends upon just how much you're obtaining, the rate go to these guys of interest, and the set term. Personal Loans copyright. Your rate of interest will certainly depend upon factors like your credit rating and revenue. Often times, personal funding rates are a lot less than charge card, yet sometimes they can be higher

The smart Trick of Personal Loans copyright That Nobody is Talking About

Perks include wonderful interest rates, unbelievably quick processing and financing times & the privacy you may want. Not every person likes walking right into a bank to ask for money, so if this is a hard spot for you, or you just don't have time, looking at on-line lenders more helpful hints like Springtime is a great option.Payment lengths for individual car loans typically drop within 9, 12, 24, 36, 48, or 60 months (Personal Loans copyright). Much shorter settlement times have very high month-to-month settlements however then it's over quickly and you don't shed more money to passion.

All about Personal Loans copyright

You could obtain a lower rate of interest rate if you finance the lending over a shorter period. A personal term loan comes with an agreed upon settlement routine and a repaired or drifting passion price.Report this wiki page